Growth in QSR through Stronger Collaboration.

Introduction

The Quick Service Restaurant (QSR) sector in Europe is undergoing profound change. Rising input costs, shifting consumer habits, and increasing market saturation are reshaping the competitive landscape. At the same time, new opportunities are emerging, driven by evolving food trends, the digital transformation of marketing, and stronger collaboration with suppliers.

Drawing on insights from senior leaders from leading QSR chains across Europe, this whitepaper highlights the key challenges facing QSR operators and outlines opportunities for suppliers who aim to build long-term, strategic partnerships.

Growth and Market Environment

The European QSR sector is estimated to reach a market size of $160–170 billion in 2025, with analysts projecting continued growth at a compound annual rate of over 4% into the early 2030s (Custom Market Insights).Within this broad market, burgers and chicken stand out as particularly dynamic subcategories.

On the burger side, global majors signal steady demand. McDonald’s reported 4% comparable sales growth in its International Operated Markets for Q2 2025, a segment that includes key European countries. Similarly, Burger King’s parent company, Restaurant Brands International, posted 5.3% system-wide consolidated sales growth, with 4.1% comparable sales at Burger King International—Europe being a major contributor to this performance. By contrast, chicken QSR concepts are expanding at an even faster pace. Yum! Brands reported that global system sales grew by 4%, driven by 5% growth at KFC worldwide, with KFC Europe outperforming at 7%.

New entrants further amplify this momentum: Dave’s Hot Chicken is rolling out around 180 restaurants across ten European countries, while Popeyes, Wingstop, and Chick-fil-A are also expanding aggressively. The implication is clear: while burgers continue to deliver mid-single-digit sales growth supported by value platforms and digital engagement, chicken is emerging as the faster-growing subsegment, propelled by rapid unit expansion and solid comparable sales gains.

Despite the highly dynamic market environment, operators face critical challenges that must be addressed to fully capture the sector’s growth potential.

Key Challenges

Connecting with the Consumer

Consumers today expect a genuine connection with the brands they choose. Traditional mass media, particularly television, is losing relevance. Younger consumers increasingly discover food brands and trends through social media and influencers.

Restaurant Experience

Beyond marketing, menu clarity, speed of service, consistent quality, and convenience are central to the in-restaurant experience. Simplification of operations and the integration of digital services are essential to maintaining brand preference. Menu simplification plays a pivotal role in this process: by streamlining choices, operations become more efficient, speed of service improves, and quality execution is easier to safeguard across all units. At the same time, a well-curated menu enhances clarity for consumers, strengthens the positioning of hero products, and ensures that innovation can be introduced without overwhelming the system or diluting brand identity.

Supplier Management

Supplier relationships are key to the success of QSR chains, which rely on full support, transparent communication across both senior and operational levels, and above all, flexibility and speed. The approval process for new suppliers, however, is often complex, involving extensive administrative work, audits, and certification requirements. This can discourage experimentation and naturally favors established partners. Nevertheless, agility and responsiveness remain highly valued, giving smaller suppliers a competitive edge in certain situations. Ultimately, unwavering product quality, supply chain resilience as well as product development capabilities and price competitiveness continue to be the decisive criteria in supplier selection and long-term collaboration.

Trends and Product Categories

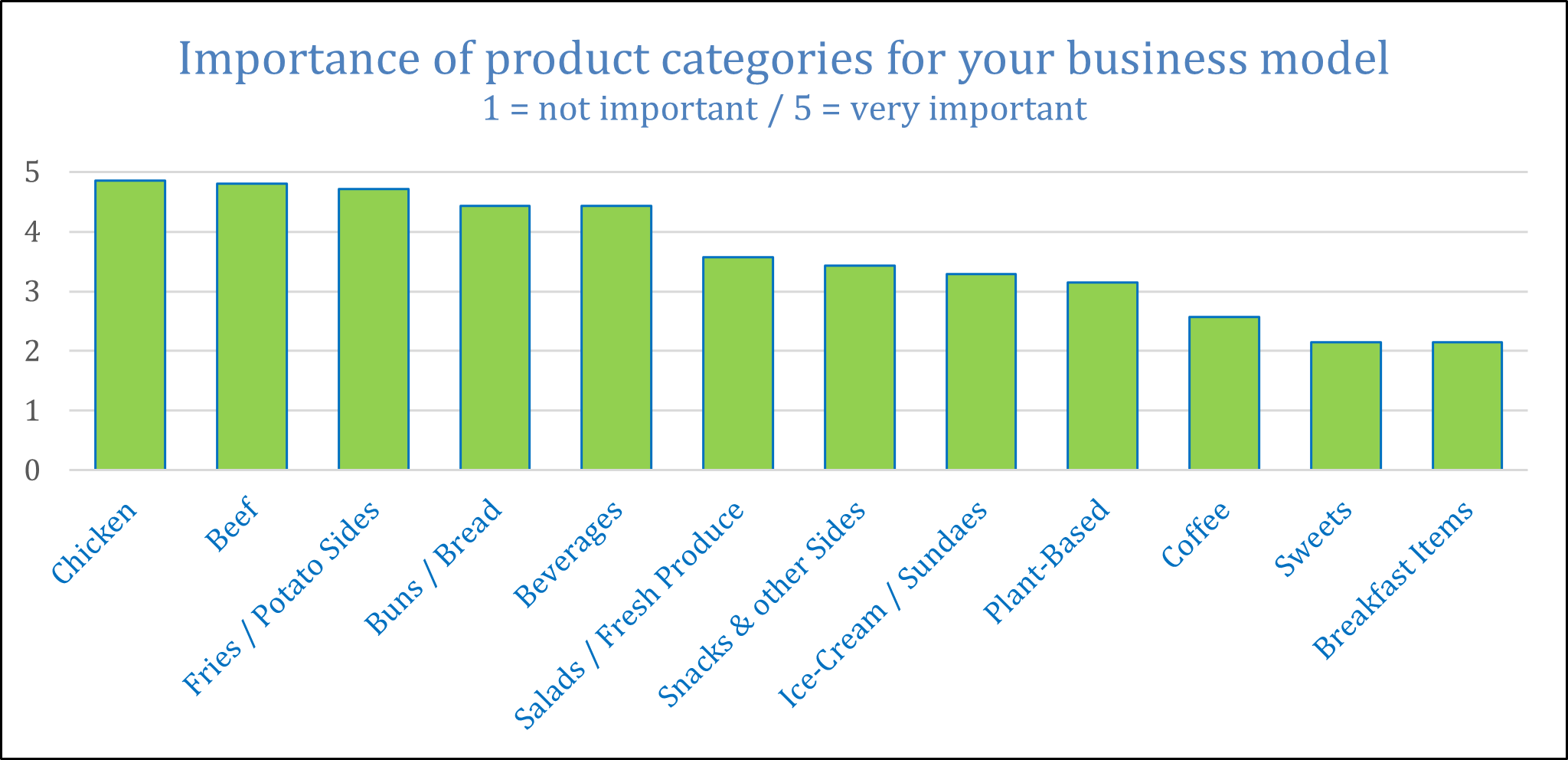

Several product categories and trends stand out as particularly relevant for future growth. Chicken, beef, potato sides, and buns are currently viewed as the most critical product categories in QSR business models, and our survey indicates that except for beef, these are also the categories with the strongest need for improved supplier partnerships.

Also, Spicy options are now expected as a standard, with at least one option in every product line. Product categories such as sides offer room for innovation, as they rotate more frequently and can provide variety without requiring long-term commitments. However, operators typically focus research on core menu items rather than secondary products, creating an opportunity for suppliers to bring forward insights and innovation in these areas.

Recommendations for Suppliers

Suppliers aiming to enter or strengthen their position in the QSR market should focus on 4 key priorities:

First, partnership is key. Close collaboration on both senior management level as well as operational level with Quality, Innovation and Supply Chain teams ensures continuous alignment on all relevant fronts and an effective delivery of common objectives.

Second, agility and flexibility are essential. The ability to respond quickly to short timelines and shifting briefs is critical.

Third, quality, supply chain resilience and product development must be treated as long-term differentiators. While price competitiveness is important, the consistent delivery of high standards builds trust and strengthens supplier relationships. Offering research, particularly in secondary categories such as sides, can further enhance value.

Finally, Limited Time Offers provide an entry point. Many new suppliers begin by supporting LTOs before progressing into the core menu through tenders. Concepts that align with consumer trends – especially in chicken, sides, street food, and spicy flavors – are especially promising.

Conclusion

The QSR sector continues to grow dynamically, supported by strong consumer demand for burger and chicken concepts. Success in this environment depends on staying close to consumer trends, delivering consistent quality, and building agile, collaborative supplier relationships across senior and operational levels. For suppliers, the message is clear: those who can offer speed, flexibility, and relevant innovation combined with a resilient supply chain, competitive pricing and reliable execution will not only win LTO opportunities but also establish themselves as long-term strategic partners.

For more information, please contact me at +49-1621039651 or tpe@qsr-consult.com.